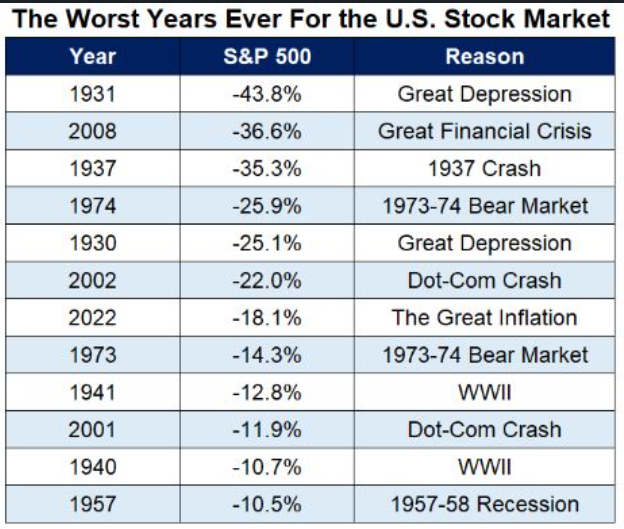

BUSINESS NEWS - The chart below shows that 2022 was the 7th worst year ever for the S&P 500, which represents the largest 500 companies in the US:

The thing about bad years in the stock market is that they are usually (not always) followed by big gains.

The chart below illustrates all the major drawdowns (orange) and bull markets (blue) in the S&P 500 since 1929.

Source: First Trust Advisors L.P., Morningstar. Returns from 1926 - 9/28/18

Source: First Trust Advisors L.P., Morningstar. Returns from 1926 - 9/28/18

Clearly, markets go up more than they go down. Even if a bad year is followed by another bad year, the data shows that the stock markets go up way more than it goes down.

Let's shift our focus back to this year.

The S&P500 is already up 15.3%, and we are only half way through the year. In fact, this marks the 11th best start to the year for the S&P in almost 100 years.

It was by no means obvious that the market was going to be this strong. We still face persistently high inflation, the ongoing war in Ukraine, and continued rate increases by central banks worldwide.

Regardless of what unfolds for the remainder of the year, this is an important lesson for investors. Just as no one predicted the drawdown of 2022, no one foresaw the rally this year.

I recall listening to an interview with Ray Dalio in December 2021. Dalio, the founder of the world's largest hedge fund, warned investors against holding cash due to the eroding effect of inflation. Ironically, cash turned out to be the best investment for 2022, as it was the only asset class that held its value.

Even the most successful individuals get it plain wrong. If a billionaire hedge fund manager can get is so wrong, what chance does the average retail investor have?

So, why do I believe that the past two years were valuable lessons for investors in terms of staying the course?

Well, what's the alternative? Should we attempt to time the markets? Should we constantly shift our money between stocks and bonds, chasing that additional 1% return at the risk of missing out on a rapid stock rally?

One lesson we've learned this year is that the stock market moves quickly.

The point is it’s incredibly difficult to predict market behaviour. Adding to this complexity is the challenge of navigating our emotions. Making sound financial decisions becomes arduous when it involves our own money. Emotions can cloud our judgment.

The toughest part of investing often lies in staying the course and refraining from making impulsive decisions. Don't let your emotions sway you. Think long term. Rather than predicting, focus on preparing with a well-structured investment plan.

Of course, all this is easier said than done.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’