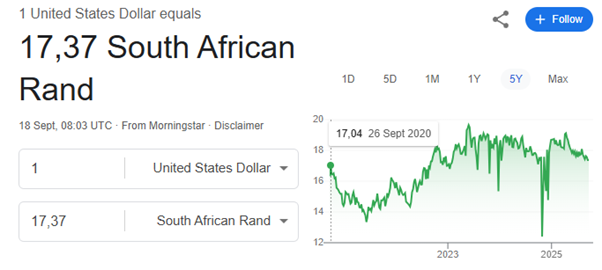

BUSINESS NEWS - Five years ago, the rand was about R17.04 to the USD.

Today, it is R17.37.

That is only a 1.9% weakening over five years, which is pretty flat in the bigger picture.

It is always difficult to pinpoint the exact causes behind the rand’s movements, and the drivers are not always the same.

For example, when Zuma fired Nene as finance minister, the rand blew out. More recently, the “Russia gate” saga, where it was suggested South Africa was supplying arms to Russia, also led to a sharp sell-off.

While local events can certainly move the rand, the bulk of the determining factors lie outside our borders.

The reality is that the rand is an emerging market currency. In fact, when large global asset managers want exposure to emerging markets, they often use the rand as a proxy because our financial system is deep, liquid and sophisticated enough to handle large inflows and outflows.

Looking at the rand’s strength since 2023, much of it comes from the unwinding of the strong USD cycle. In other words, it is not just the rand strengthening, it is also the dollar weakening against most global currencies.

You may remember in 2022 when central banks around the world hiked rates aggressively. With US money market yields near 5%, global capital poured into the US and the greenback surged.

Now that inflation has cooled and markets are pricing in a Fed cutting cycle, the dollar is retreating.

The USD is weakening against all major currencies.

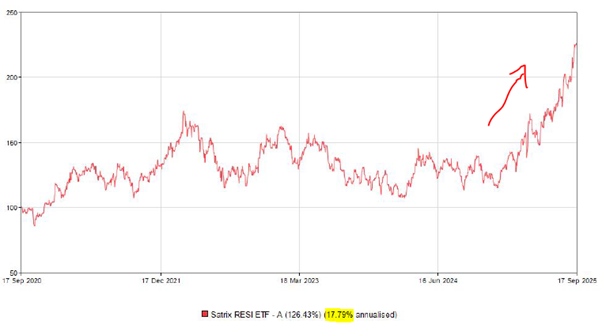

On top of that, South Africa has its own tailwind in the resources sector. Our economy is heavily weighted towards commodities, so when the resources sector runs, the rand tends to strengthen. We also get bumper tax collections years which is a nice way of funding the fiscus (takes some strain off individual and business tax rates)

Have a look at the resources sector over the past five years. It has delivered an annualised 17.8%. That's really fantastic, especially after a decade of doing almost nothing.

Chart: Resources sector performance – Satrix Resi

Chart: Resources sector performance – Satrix Resi

And look at the rally since the start of this year. It lines up almost exactly with the rand’s strength over the past few months.

If this sector continues to run, it could provide further support for the rand in the months ahead. Let's see how it unfolds.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

Read more opinion pieces here.

‘We bring you the latest Garden Route, Hessequa, Karoo news’