BUSINESS NEWS - I’ve taken some time to reflect on the past 3 years of markets with a view for how 2024 may unfold.

The biggest stories since Covid have been inflation and interest rates. These two data points, and expectations around them, have had huge influence on market movements.

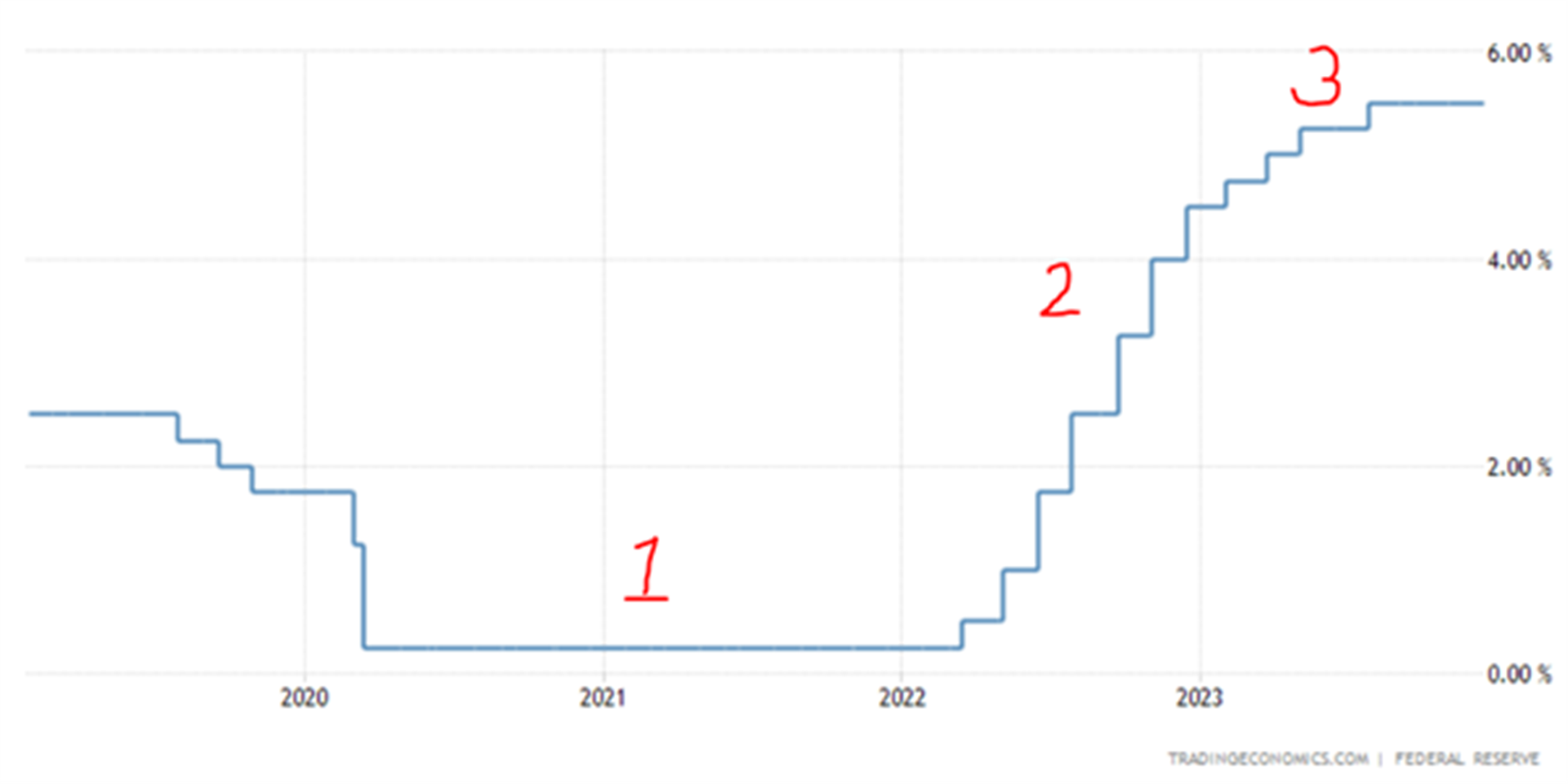

The US Fed and central banks around the world dropped their interest rates to close to zero in the wake of Covid to soften the blow to the consumer. Consequently, interest rates on cash dropped considerably – in South Africa cash rates dropped from around 9% to 4%, and in the US, cash rates dropped from around 3% to around 0.25%.

The low cash rates meant investors who previously held cash to meet their return requirements had to find an alternative. In fact, cash was generating returns lower than inflation, so you were losing money.

Consequently, everyone jumped into equities. And equities rocketed up in late 2020 and throughout 2021.

- Period 1 in the repo chart which shows how low the rates went in 2020

- Period 1 in the MSCI World chart shows how equities soared over this same period

Chart: Fed Funds rate (interest rate) in America over the past 5 years

Chart: Fed Funds rate (interest rate) in America over the past 5 years

Chart: Performance of the MSCI World Index over 5 years (all developed markets)

Chart: Performance of the MSCI World Index over 5 years (all developed markets)

I remember listening to an interview with Ray Dalio in December 2021 (one of the largest hedge fund managers in the world) who, at that time, remarked that ‘cash is trash’

This was the consensus view at the end of 2021. Many smart financial people with many degrees concurred – why invest in an asset class (cash) that was generating only 0.25% per year?

Well, it turned out cash was the best performing asset class for 2022 (every other asset class bombed out – see period 2 in the MSCI World chart from 2022 to 2023).

What happened?

Well, we saw the rapid rise of inflation in 2022, and then the rapid rise in interest rates in an effort to contain it - see period 2 in the repo rate chart above.

The result was devastating for stocks around the world. The MSCI World index dropped 17.7% in 2022. The S&P500 dropped 19.44%.

The rise in the repo rate meant that cash had again become attractive – in South Africa, we went from 12 month deposits offering 4% in 2021 to offering 9% at the end of 2022.

That’s a significant shift and good reason to move out of the market and into cash.

In the US, cash rates went from 0.25% in 2021 to 4.5% in 2022. And remember, this is cash. It’s essentially risk free.

So, end of 2022 comes around, and the consensus view was that the rapid increases in interest rates would inevitably lead to recession. This made cash a seemingly smart investment option.

Why risk being in the stock market when you could park your funds in a cash account and earn a guaranteed 4.5% in USD?

It was perfectly logical that the higher interest rates would strangle the economy and move it into a recession.

But it didn’t. There wasn’t a recession.

Instead, the US stock market rose 26.3% in 2023 (see period 3 in the MSCI World chart). The market outperformed cash by almost 22%. Cash was a terrible move.

Once again, the consensus view was not just wrong, but devastating for anyone that followed it.

So, where do we find ourselves today? What is the consensus view today?

Well, bond yields locally are sitting just below 10%.

In the US, they are sitting on about 4% (the 10 year yield curve) after hitting 5% in October last year.

The consensus view is that interest rates will start coming down in the second half of the year (I’ve read about 6 asset manager forecasts for this year, and everyone agrees that it will be second half of this year), and with that, you will get the bond yields AND some capital appreciation.

In short – invest in bonds for 2024.

Matthew Matthee

Matthew Matthee

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’