BUSINESS NEWS - Almost half of the workers feel underpaid – South African professionals are turning to “side hustles” amid rising prices.

The following findings were concluded as:

- 45% of South African professionals feel underpaid for the role that they do

- 18% resorting to “other means” of additional income for the first time, including credit cards, pay-day loans, and additional work

- Call for employers to be positive and supportive toward “side hustles” - fast becoming a “necessary evil” that employers must accept

- A third of professionals have stated that they are “actively seeking” additional work – as primary forms of employment fall short on pay, progression, and purpose.

According to research by global recruiter Robert Walters, 48% of professional workers in South Africa do not feel that their pay is an accurate representation of the work they do.

This comes off the back of a summer which recorded the highest consumer inflation rates in 13 years, reaching up to 7.6% - which despite a slight drop in September (7.5%), still remains higher than pre-pandemic levels.

Megan Prosser, Senior Manager – Robert Walters South Africa: “It’s not surprising that professionals are starting to feel that their pay isn’t stretching as far as it used to, given that the price of essential goods is rising across the world.

In some respects, employers feel that their hands are tied – it is not realistic for companies to try and compete with rates of inflation, especially in what is an unpredictable market.

“We have seen a significant rise in professionals taking on side hustle’s as a way of arming against increased costs and a looming recession; evolving what was once a passion into pay.

Historically, side jobs have been considered something of a distraction by employers, however, additional jobs can also be a great way of developing new skills, which could actually benefit the primary employer.

“The crucial advice here for employers is to listen and play an active role in alleviating some of the external pressures on their employees. If this can’t be done via a pay increase, then this can be achieved by encouraging resourcefulness in an economically strenuous time.

Cost-of-living

According to a survey of 2,000 South African professionals by Robert Walters, 45% said they now feel underpaid.

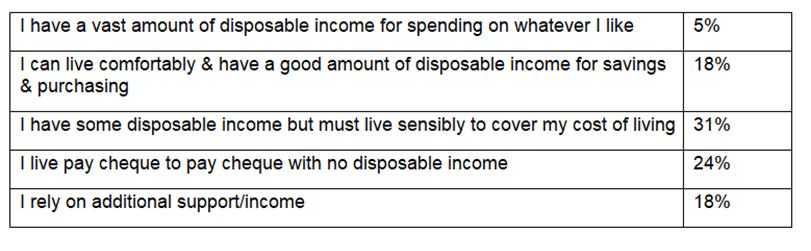

When asked about pay in relation to the cost of living, only 5% said that they had a generous disposable income, with the majority (31%) stating that they have to live sensibly to cover their cost of living. Less than a fifth make enough to warrant savings. Worryingly a quarter of professionals (24%) live ‘pay cheque to pay cheque.

Almost a fifth of professional workers (18%) are resorting for the first time to other means to supplement their cost of living.

This can include credit cards, payday loans, and additional work – most commonly referred to as “side hustles”, with this being much more prevalent in workers under the age of 30.

Megan adds: “Traditionally side or weekend jobs have been viewed as a potential distraction by employers, with some companies fearing that additional work can decrease productivity in a professional’s primary role.

“Times are changing and in fact we are learning that employers need to be flexible, and that leaders must be empathetic to the fact that, for some, a side hustle is not just a passion-project, but a necessity.

“I would encourage businesses to have an open mind about their employees' extra-curricular activities, on a case-by-case basis – encouraging them to bring that level of initiative and entrepreneurialism to the workplace

“Don’t underestimate what value a side-hustle can bring to the day job e.g., a financial advisor having a huge TikTok presence. Such skills could be utilised in their day job and become of great value to the company.

“Employers can also consider offering a platform within the business – whether it is allowing them to sell cakes or crafts in the office lobby, hosting a lunchtime yoga session, or the ability to promote what they do on the intranet or internal notice boards.”

Megan Prosser – Robert Walters South Africa – shares her top tips on how companies can support employees with the cost-of-living crisis, using non-financial incentives:

- For office days, introduce flexible start & finish times, to help employees avoid the cost of peak travel, and to help them gain back extra time in their day

- Flexi-hours, enhanced leave or one additional day’s paid leave per month when targets are hit, allow staff to develop their side hustles outside of work hours, relieving some pressure in multiple ways

- Create a reward structure which ties into the Cost of Living – for example streaming subscriptions, food vouchers, or flight allowances

- Introduce low-cost complimentary breakfasts in the workplace. Don't underestimate the value of cereal, pastries and fruit baskets can bring to your employees' days

- Double down on progression routes and offer enhanced training programmes. If employees are not happy with pay, show them the clear route to earning more within the company/their primary employment

'We bring you the latest Garden Route, Hessequa, Karoo news'