BUSINESS NEWS - When I started writing these opinion pieces, I feared that I may lose ideas for content. Each week, I scan various publications. Market charts are monitored closely, investigating trends in the US, Europe, China, and local activities on the JSE. There's always some story or some interesting piece of data coming out that's worth thinking about.

The market was relatively quiet this week, with the JSE holding steady and the S&P 500 up by 0.57%—much of a muchness. I don't expect big movements this December. Everyone is looking forward to year end.

In local news, the school holidays have arrived. My daughter went on holiday on Wednesday, and we enjoyed an afternoon at Buffalo Bay. Tourists and holidaymakers have descended upon us in full force.

It’s interesting living in a town whose economy is built for tourism.

The swallows (foreign tourists) from the UK and Europe are all here, and the local establishments are preparing for their busiest season. Locals vacate their homes to rent out on Airbnb from anywhere between R1000 and R10 000 a day – this is a meaningful part of their annual income.

I’m glad the tourists feel welcome here. They wouldn’t come if they didn’t. It’s also very affordable – a good steak costs a fraction of what it would cost in the UK (and tastes better). This not only benefits visitors but also provides great tips for locals and enables businesses to hire more people.

It’s not really surprising that tourists go where they feel welcome. It’s the same with money. If you consider financial flows in the world, you will spot an interesting (but not surprising) trend.

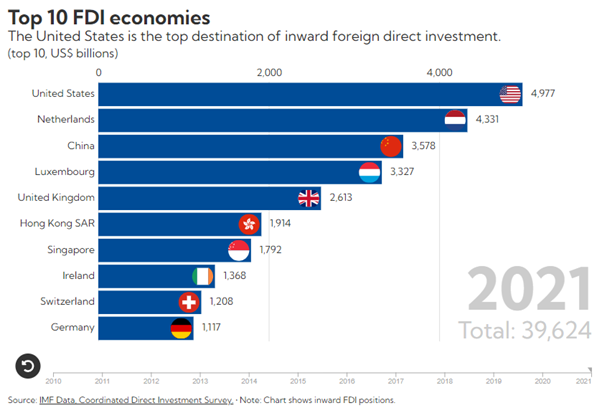

In 2021, the United States recorded the largest increase of foreign direct investment of all economies in the world.

The chart below shows the top destinations of inward foreign direct investment for 2021.

Is it correct to say the US is the best tourist destinations for your money? Well, just look at their market returns over the past century, and you will understand. The data certainly agrees.

I’m glad that, as a South African, I can easily invest in great US companies like Apple and Microsoft. I don’t have to worry about property rights, about loadshedding, about politicians interfering with business or creating onerous regulations that take up additional resources. I feel my money is welcome in the States and will be looked after with care.

We couldn’t do this 50 years ago. Hardly anyone could.

As the year comes to an end, let's take a moment to appreciate the opportunities and advantages we have, whether in global investments or the simple pleasures of the festive season and time with family.

Wishing you all a joyful and prosperous holiday season.

Matthew Matthee has a wealth management business that specialises in retirement planning and investments. He writes about financial markets, investments, and investor psychology. He holds a Masters Degree in Economics from Stellenbosch University and a Post Graduate Diploma in Financial Planning from UFS. MatthewM@gravitonwm.com

‘We bring you the latest Garden Route, Hessequa, Karoo news’